Table of Contents

ToggleIntroduction

When you’re caught in a financial pinch, payday loans can seem like a lifesaver. Services like Eloanwarehouse aim to make the process of borrowing emergency cash faster, simpler, and more convenient. But before you take the plunge, it’s vital to understand how these loans work, their costs, and the potential risks.

This article provides an in-depth look at payday loans through Eloanwarehouse, empowering you with the knowledge needed to make informed decisions. From understanding their benefits to exploring alternatives and legal regulations, we’ve got all the details covered for you.

Important Details About Payday Loans Eloanwarehouse (Summary Table)

| Feature | Details |

|---|---|

| Company | Eloanwarehouse |

| Loan Type | Payday loans |

| Loan Amount | Up to £1,000 |

| Approval Time | Same-day approval, typically within hours |

| Interest Rate (APR) | Up to 400% |

| Repayment Term | Typically 14 to 30 days |

| Credit Check | Not required for most loans |

| Fees | Varies by state; includes late/re-roll fees |

| User Rating | 4.2 out of 5 (based on customer reviews) |

| Availability | Online platform in select jurisdictions |

With this snapshot, you’ll understand the basic framework of payday loans offered by Eloanwarehouse. Now, let’s explore the details further.

What Is Eloanwarehouse and How Do Payday Loans Eloanwarehouse Work?

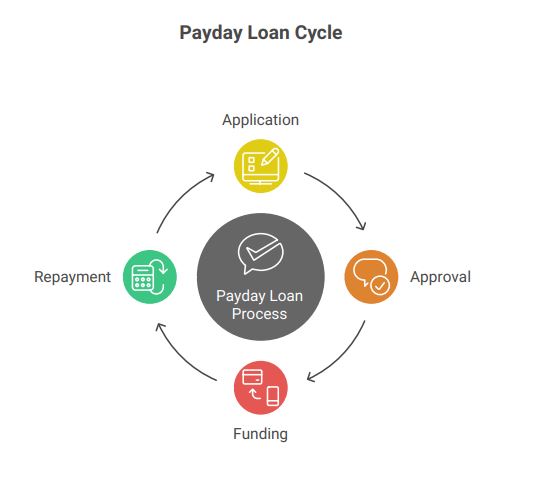

Eloanwarehouse operates as an online loan matching service, connecting you with lenders who provide short-term payday loans. Here’s how it typically works:

Lifestyle LookWhatMomFound – Where real family life meets heartfelt inspiration. Explore lifestyle tips at beatlar.com

- Application

Fill out a simple online form detailing your financial situation and loan amount required.

- Approval

You receive a decision within minutes, often without credit checks. Many loans are approved the same day.

- Funding

Once approved, the funds are deposited directly into your bank account—no long waits.

- Repayment

Loans are repaid automatically on your next payday, either as a lump sum or installment.

This streamlined system is ideal for emergencies where time-sensitive cash solutions are needed.

Benefits of Using Eloanwarehouse for Emergency Loans

Why choose Eloanwarehouse over others? Here are key benefits:

“Transform your home with Beatlar.org! Get expert tips on décor, DIY projects, and lifestyle upgrades.”

- Fast Approval Process: Unlike traditional banks, decisions are made quickly—sometimes in minutes.

- No Credit Checks: Even borrowers with poor credit histories can qualify for loans.

- Accessibility: Eloanwarehouse operates fully online, removing physical branch visits and queues.

- Clear Terms: Transparent loan agreements ensure you know exactly what to expect.

Real-life user reviews highlight another advantage—responsive customer service, rated 4.2 stars for its helpful support team.

Experience lakeside living at Lighthouse Landing, where comfort meets nature, and every sunset is a picture-perfect moment.

“The entire process was seamless. I had the funds in my account the same day, and their team was quick to respond to my questions!” – Sarah J., 5-star review

However, while there are benefits, borrowers must also carefully consider the costs and potential challenges.

Understanding the Actual Costs of a Payday Loan: What You Will Really Pay

Payday loans come with high-interest rates and fees, making them an expensive borrowing option if not repaid promptly.

Make your shopping easy with treeleftbigshops, offering premium items at prices you’ll love.

Breakdown of Costs

- APR: Typical payday loan APRs can reach 400% or higher, depending on state regulations.

- Fees: Late payments or rollovers may incur additional fees, compounding your debt.

For example, borrowing £500 for 14 days at an APR of 391% could cost you £75 in fees—a hefty price for short-term relief.

Possible debt cycles from payday loans are one reason they remain controversial. Always assess affordability before committing.

Who Should (and Should Not) Apply for Payday Loans Eloanwarehouse?

Ideal Candidates:

- Individuals facing temporary financial emergencies (e.g., medical, car repairs).

- Borrowers with limited access to traditional credit options.

Who Should Avoid It:

- Those unable to repay loans in full within the repayment period.

- Applicants in long-term financial distress, as high-interest rates can worsen debts over time.

Instead, explore alternatives if your financial needs are ongoing.

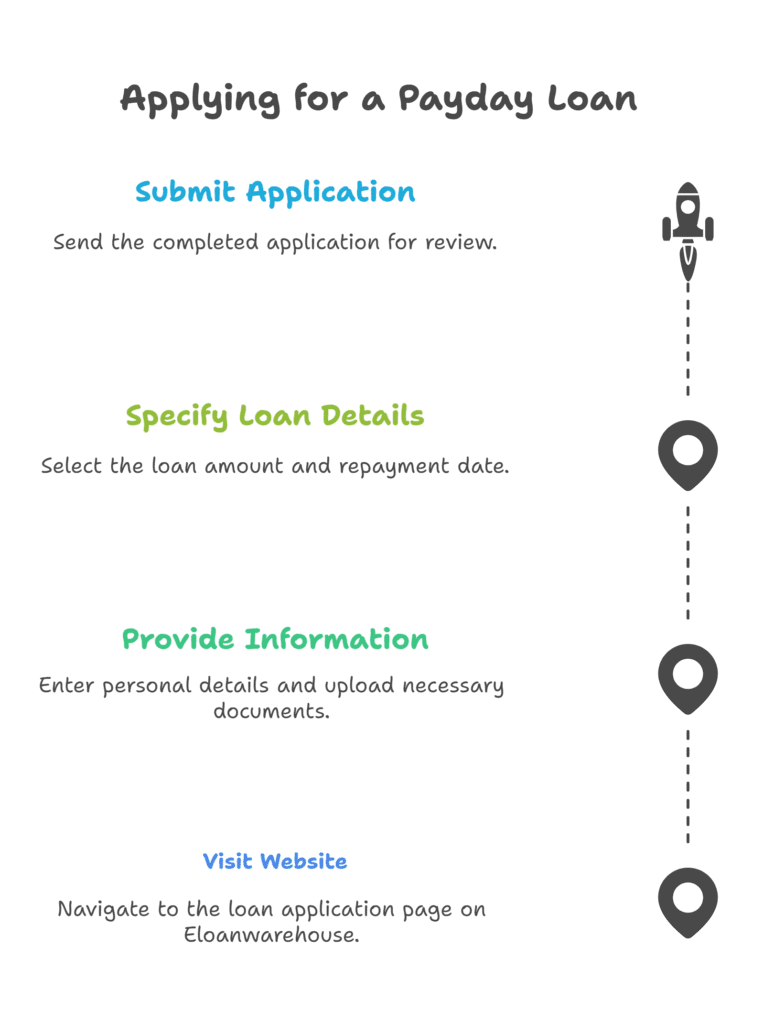

The Application Process – A Step-by-Step on Eloanwarehouse

Here’s how you can apply for a payday loan through Eloanwarehouse:

- Visit Their Website and navigate to the loan application page.

- Provide Personal Information, including ID proof and employment verification.

- Specify Loan Details—choose your desired amount and repayment date.

- Submit Application and wait for approval.

- Most users find this digital loan platform intuitive and easy to use, making funds accessible within hours.Alternatives to Payday Loans Eloanwarehouse: Smarter Ways to Find Fast Cash

Before committing to a payday loan, consider these alternatives:

- Borrow from Friends or Family: Personal loans often come interest-free.

- Credit Card Advances: While also costly, they may offer lower interest than payday lenders.

- Community Assistance Programs: Many charities provide financial emergency solutions to those in crisis.

Choosing wisely can help you avoid the high stakes associated with payday lending.

Legal and Regulatory Factors You Must Know

Payday loans are regulated heavily in many areas within the UK and beyond. Here’s what to look for:

- Interest Caps: Some states and countries limit APR to protect consumers.

- Licensing: Ensure the lender is legally registered.

- Military Lending Act: Special protections exist for active-duty military members.

Always verify state laws governing payday lending in your jurisdiction to avoid illegal practices and unfair terms.

How Payday Loans Impact Credit (Even When Lenders Don’t Report)

Most payday loans are not reported to major credit bureaus, meaning they won’t directly affect your credit score—positively or negatively. However:

- Missed Payments: If sold to collections, they can hurt your credit.

- Debt Cycles: Persistent unpaid loans poison long-term financial stability.

Consider credit impact carefully before borrowing.

Payday Loans Eloanwarehouse vs. Installment Loans: The Key Differences Described

| Feature | Payday Loans | Installment Loans |

|---|---|---|

| Loan Amount | Smaller (<£1,000) | Larger (£1,000+) |

| Repayment Period | Short-term (14–30 days) | Long-term (months to years) |

| Interest Rate (APR) | Higher | Lower |

| Credit Impact | Limited | Can help build credit |

If managing financing over time matters, installment loans are generally more forgiving.

Long-Term Financial Security:

The Value of Smart ChoicesRather than relying on payday loans repeatedly, building financial security through budgeting and savings is the best approach. For instance:

- Create an emergency fund for unexpected expenses.

- Explore personal finance tools for tracking and managing expenditure.

This proactive strategy reduces dependency on loans during future crises.

FAQs

1. How fast can I get a payday loan through Eloanwarehouse?

Funds are often deposited the same day if approved before the daily cut-off.

2. Is Eloanwarehouse a direct lender?

No, it operates as a loan matching platform, connecting borrowers with lenders.

3. Can I apply with bad credit?

Yes, no credit check loans make Eloanwarehouse accessible for borrowers with poor credit.

4. What are the risks of payday loans?

Key risks include high-interest rates, potential debt cycles, and re-borrowing fees.

5. Are payday loans legal everywhere?

No, some jurisdictions have banned payday loans entirely. Check regulations in your state.

Admin Recommendation

Luxury Villas in Italy: Discover Le Collectionist’s Finest

Mastering the Mentor Ladder: A Guide to Rope Stairs

Discover Your Dream Home: Homes for Sale in Southwest Ranches, South Florida